Monetary Premium: Cash is Trash

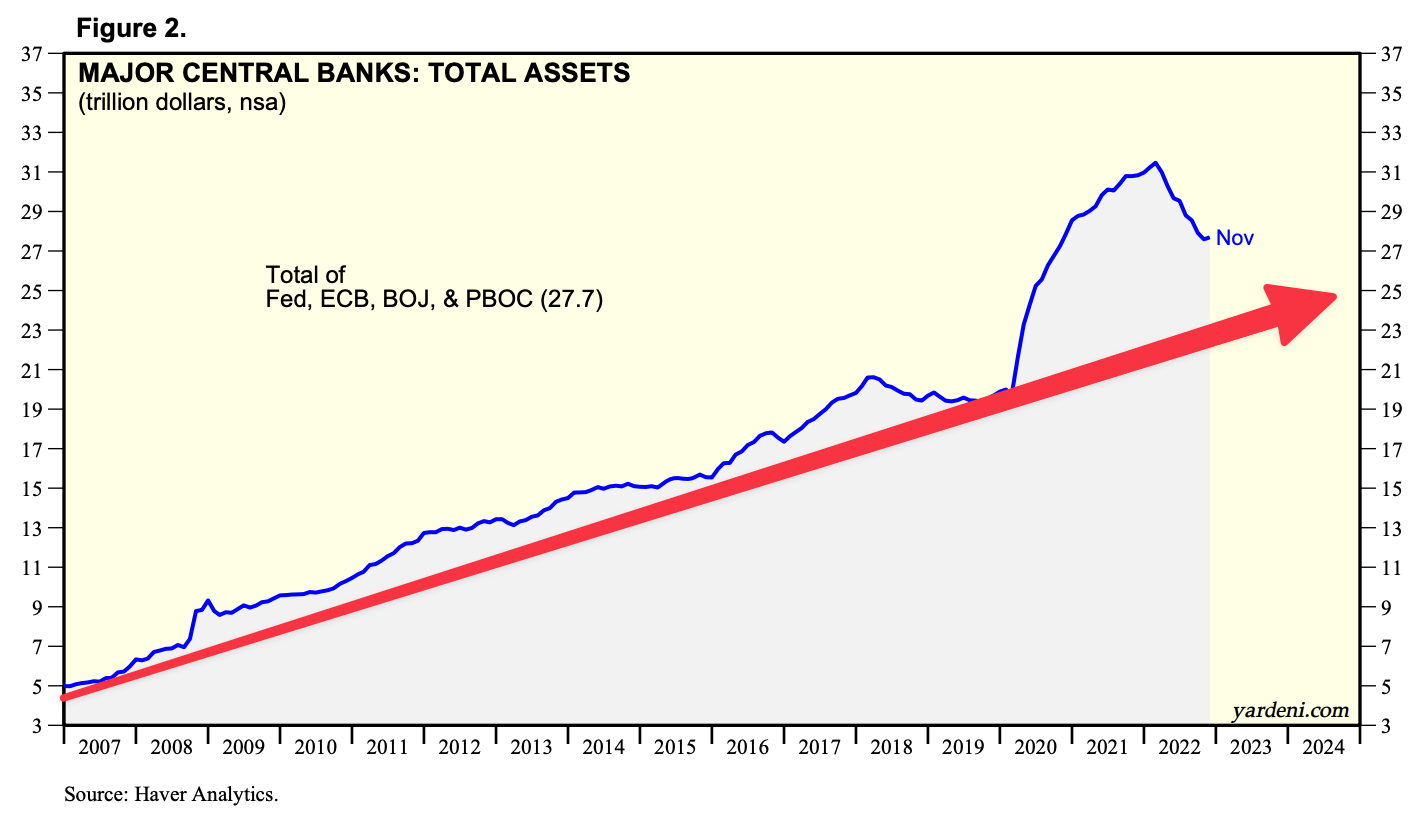

When Ray Dalio uttered the words "Cash is trash!" on CNBC in early 2020, he seemingly broke the fourth wall.

For someone of his stature and influence within the political machine to acknowledge the chronic and unavoidable debasement of fiat currency was a clear turning point.

While he has since reversed his position (temporarily), his point still stands. The perverse incentives of the fiat system—to siphon value from savers via debasement—lead only to more of the same.

[House Committee on Financial Services, July 2013]

Congressman Keith Rothfus: Where does the Fed get the money to buy [assets], do you create the reserves?

Ben Bernanke: Yes.

Congressman Keith Rothfus: Are you printing money?

Ben Bernanke: Not literally.

Natural Selection

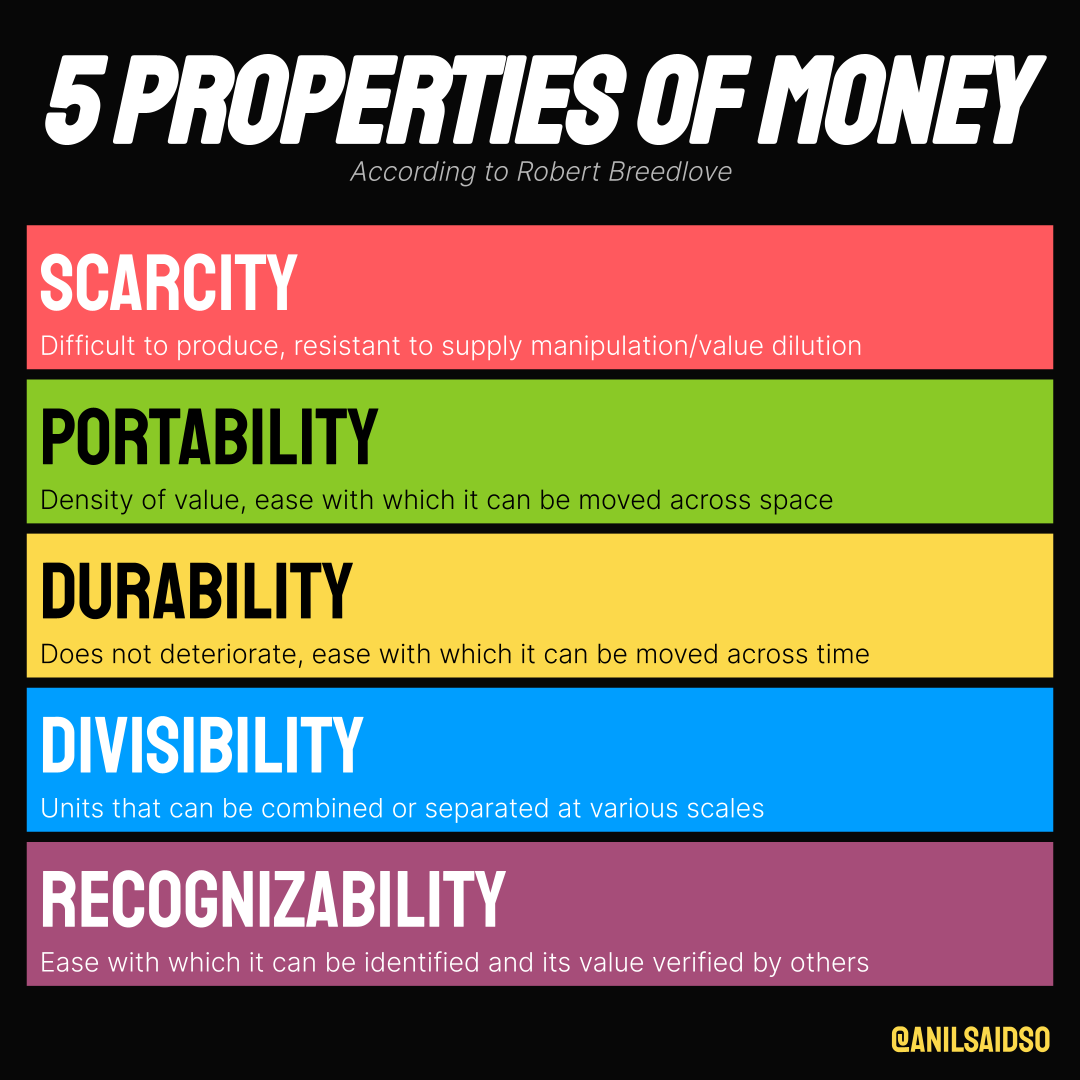

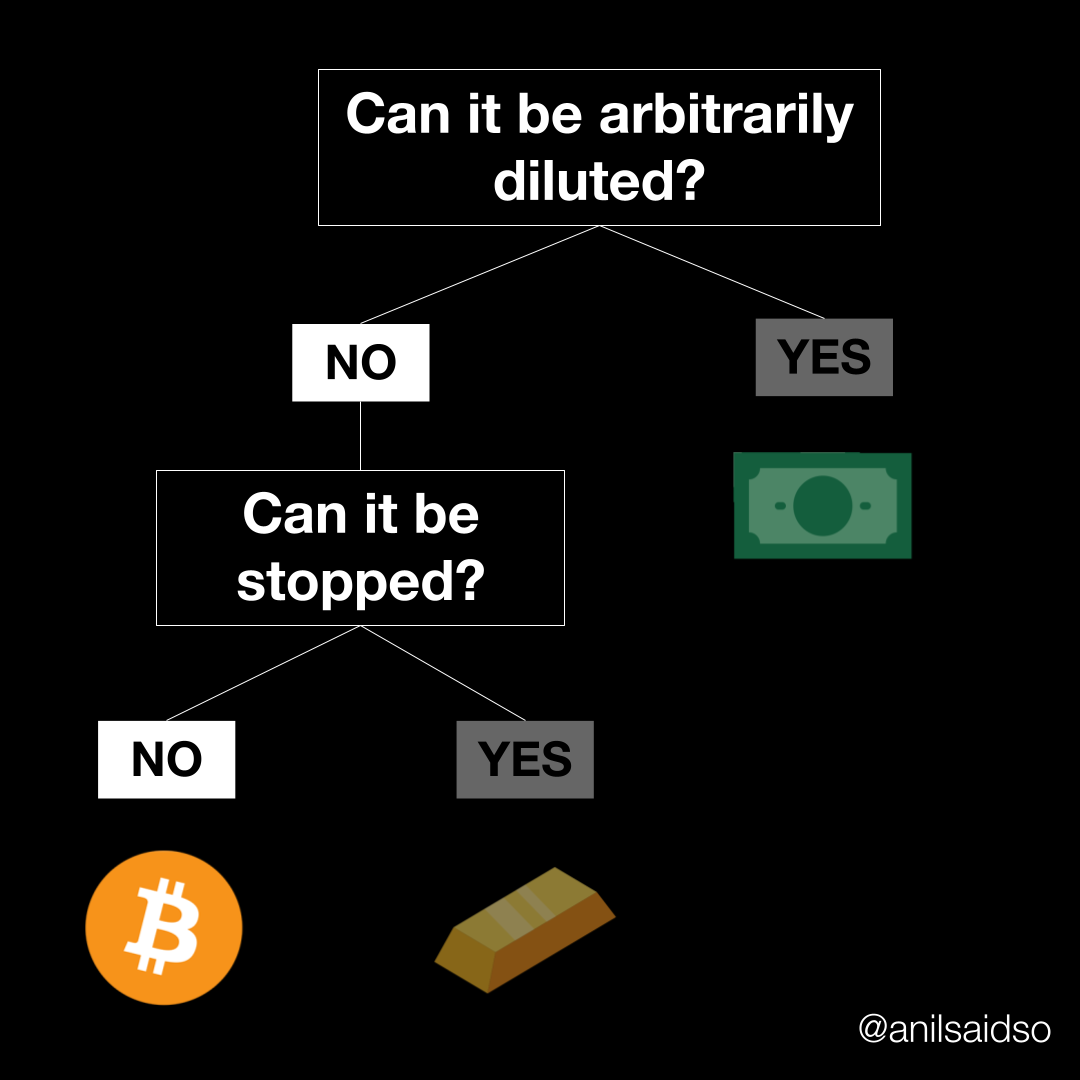

Money is chosen (or imposed in the case of fiat) as simply the most salable good within a society based on a number of desirable characteristics.

Let's focus on scarcity.

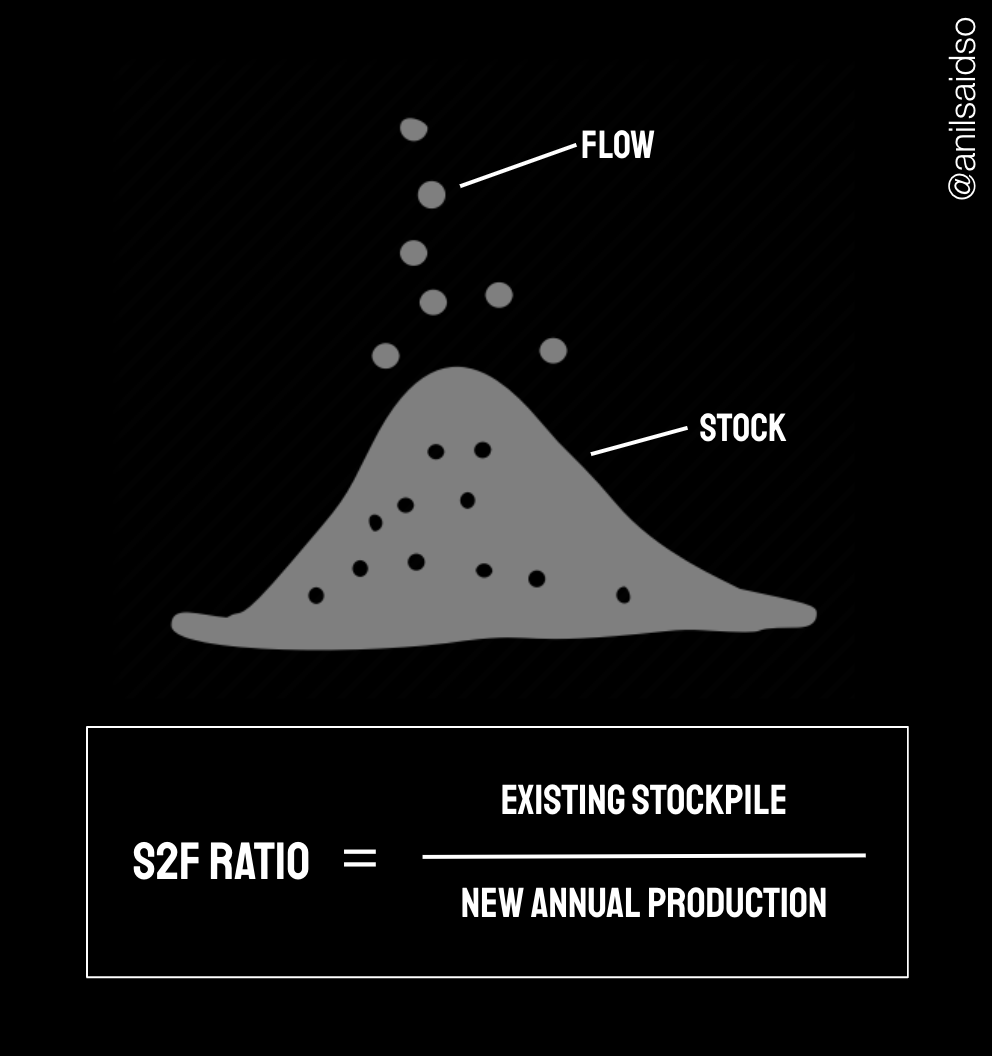

Scarcity in the context of monetary goods is inextricably linked to the relatively difficulty of producing additional units.

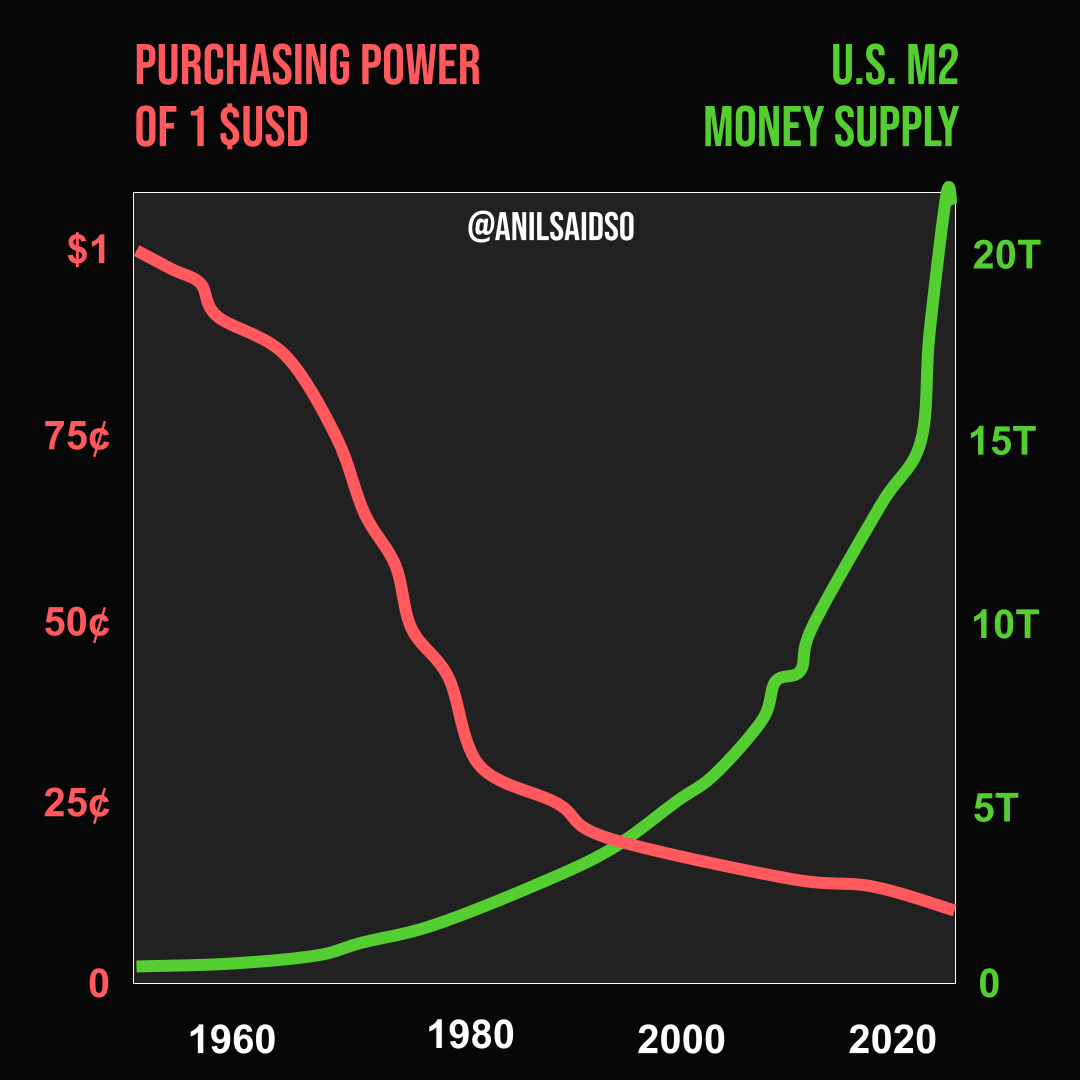

If there is little to no work/sacrifice involved in the production of a money, its scarcity will soon be violated and it will cease to function as a mechanism to preserve purchasing power.

Savers then seek out alternative goods and assets to protect their purchasing power, attracting a monetary premium.

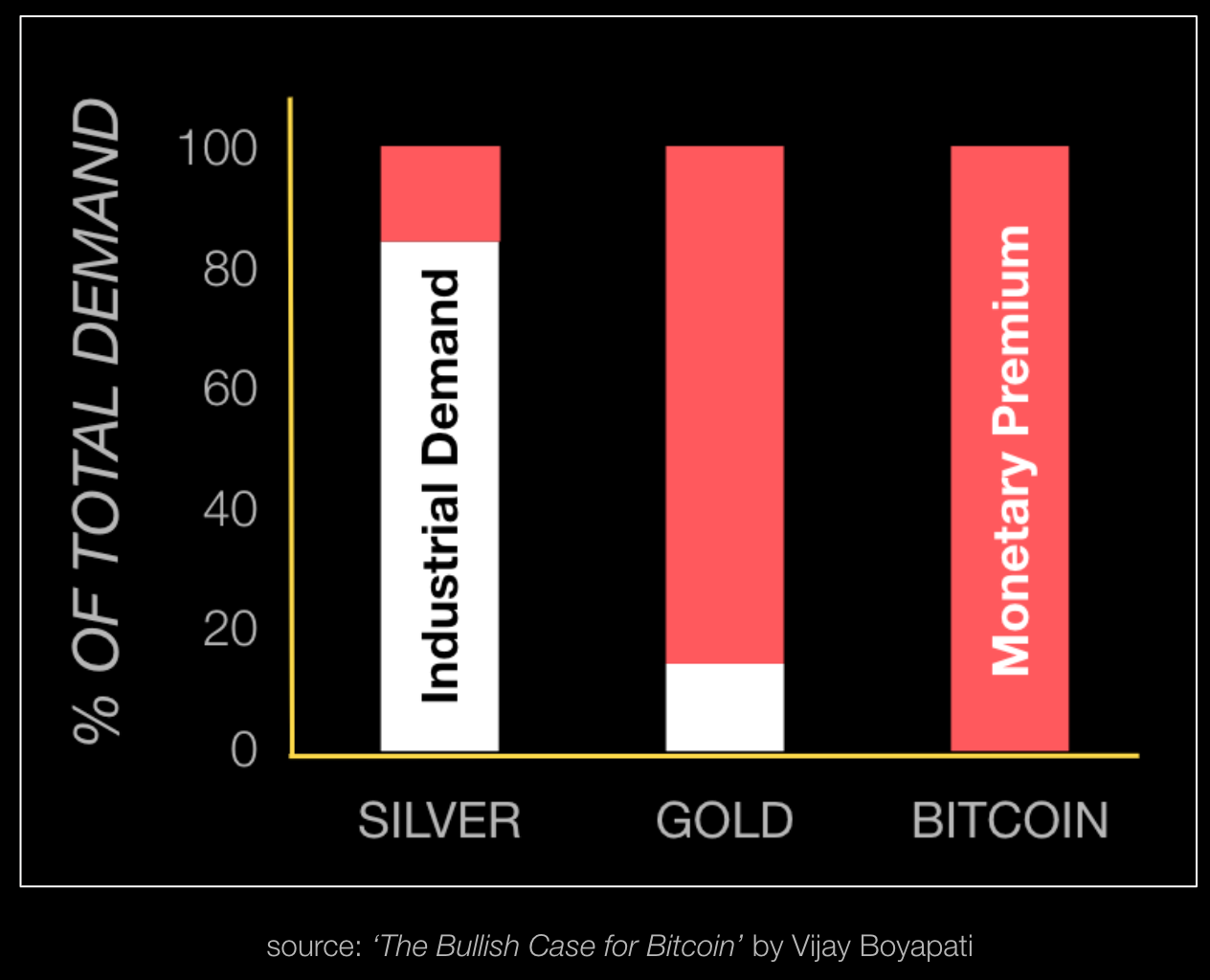

The difference between the purchasing power of a monetary good and the exchange-value it could command for its inherent usefulness can be thought of as a “monetary premium”. —Vijay Boyapati (The Bullish Case for Bitcoin)

"When the dominant money becomes terminally ill, we witness the short term monetization of everything else.” —Tuur Demester

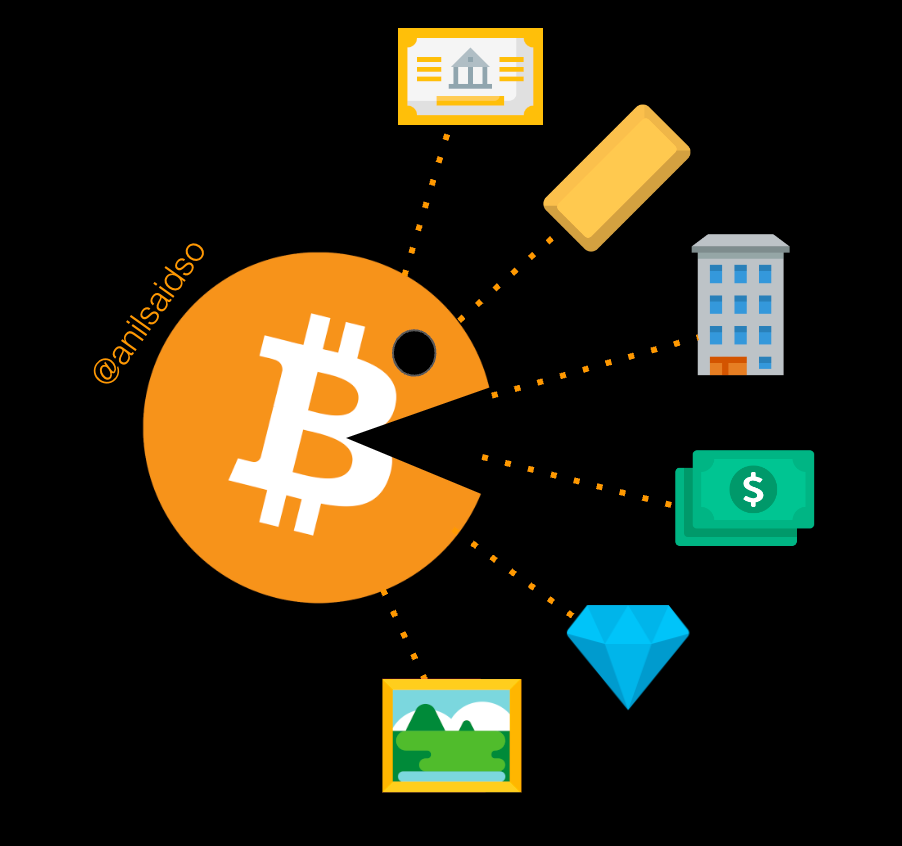

As is the case in the slow death of any fiat currency, monetary premiums have now accumulated in a range of asset classes; from technology stocks to residential real estate, and from trading cards to fine art. All searching for the least future uncertainty.

Bitcoin has Entered the Chat

What would you need to be assured of to store value in something for a year, a decade, or a century?

In the game of wealth preservation, uncertainty reduction is king.

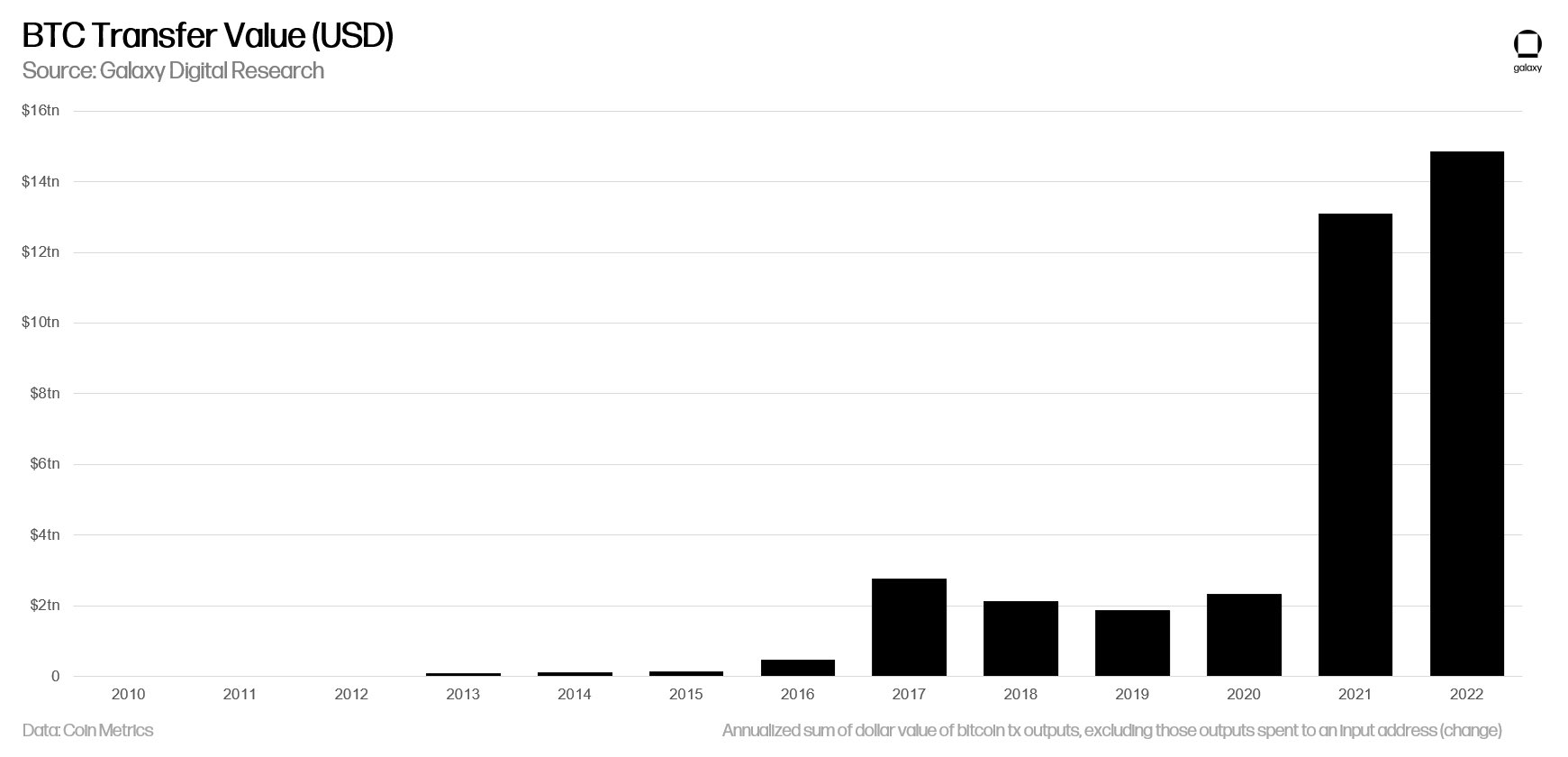

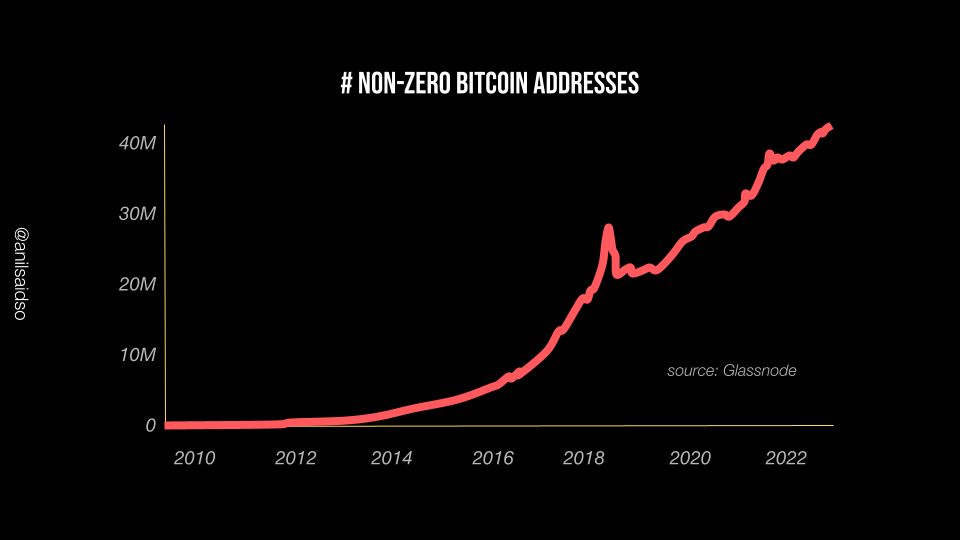

When a superior form of money emerges, it grows by effectively draining these premiums.

While the process of monetization is never a smooth and steady path, some observations can help determine if the trend has legs.

For the cautious or unconvinced, it may be an easier exercise to consider what is likely to be demonetized in the future and simply seek to avoid having the bulk of your wealth in that.

Chances are this process of elimination will eventually lead you to bitcoin in due time.