Winner-Take-All: No Time For Losers

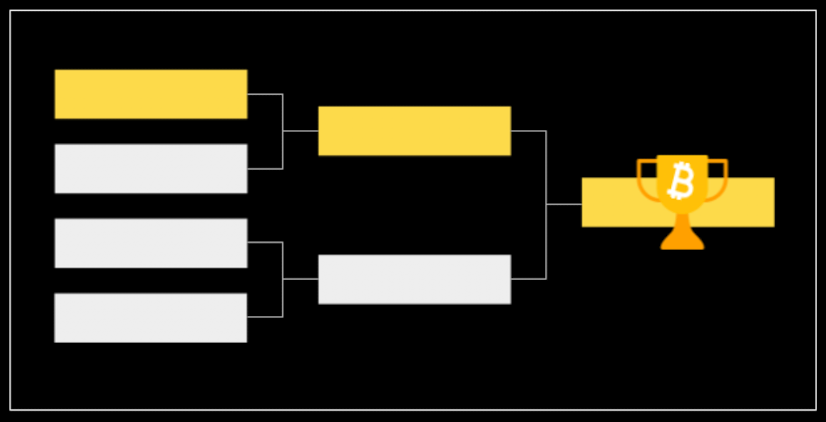

Competitions where the single best performer captures the entire reward on offer.

Imagine if you ran a small bakery and could only list your business hours on ONE of these two platforms: Google maps or Bing maps (any possible ChatGPT integrations aside).

You'll go to where the eyeballs are. And the eyeballs will be where the strongest network effects exist (because people's attention is finite).

"Any decision that involves using a limited resource..will naturally result in a winner-take-all situation. Where your performance relative to those around you is the determining factor in your success." —James Clear

Let's focus on networks that move information from A→B.

They get built out (and evolve) around methods that are able to offer significant advantages in speed, cost, access, reliability, or precision. I say 'significant' because any benefit must more than compensate for any switching costs.

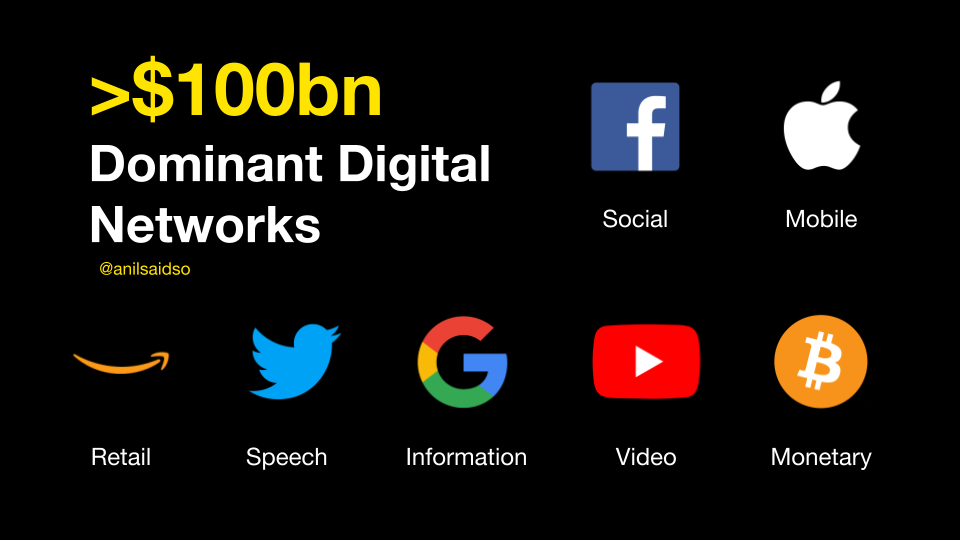

Dominant Digital Networks

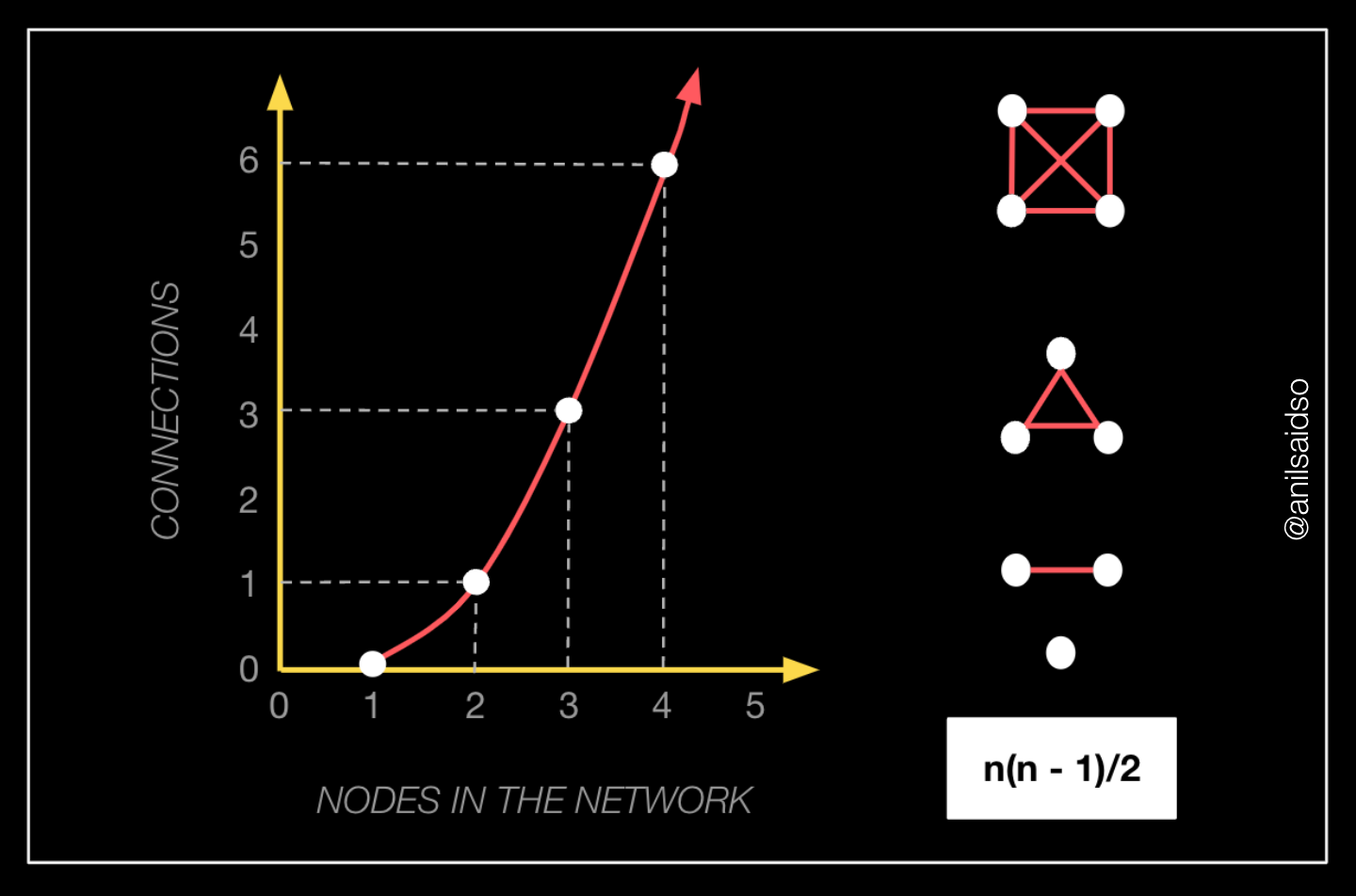

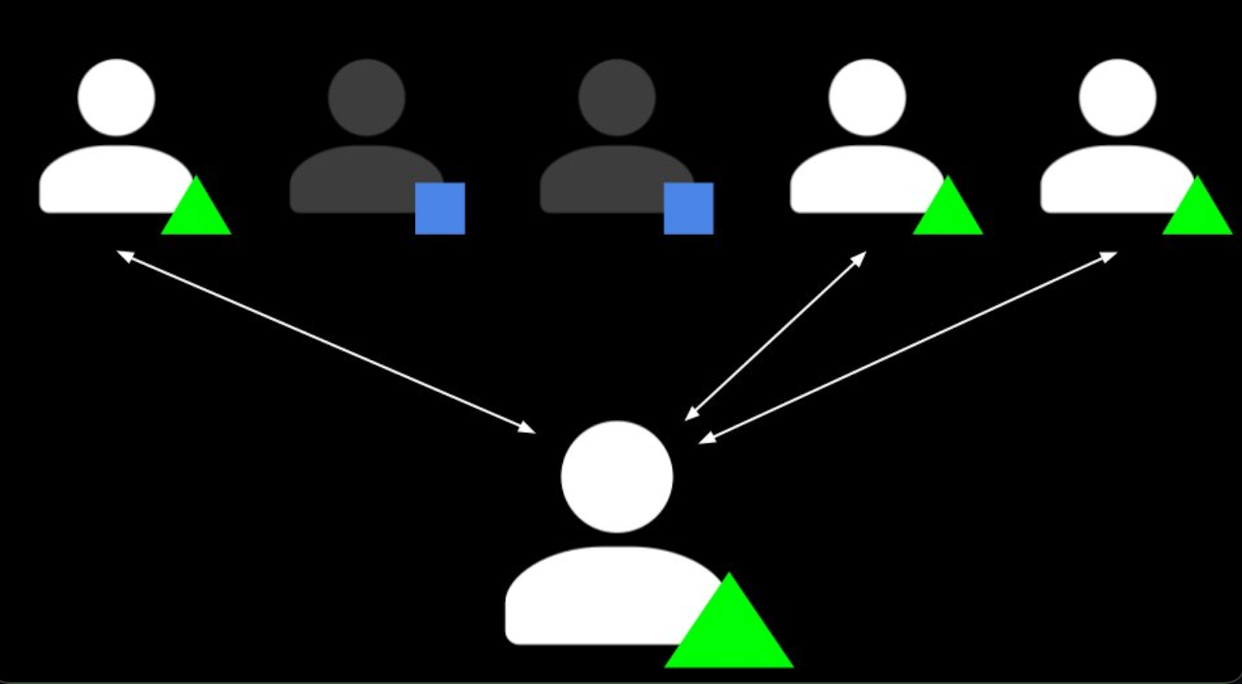

Networks that are superior across one or a combination of the previously mentioned dimensions, can experience network effects: non-linear, exponential growth with the addition of each marginal user.

More users = more possible connections = more potential utility

Google, Amazon, and Apple are examples of players that offer a superior experience to competitors and came to dominate their core industries through network effects. The key difference is that the internet enabled them to operate in a massive single global market.

For this reason, the titans of the Digital Age witnessed network effects on steroids, due to speed, reach, and innovation.

"There's never been an example of a $100b dollar monster digital network that was vanquished once it got to that dominant position." —Michael Saylor

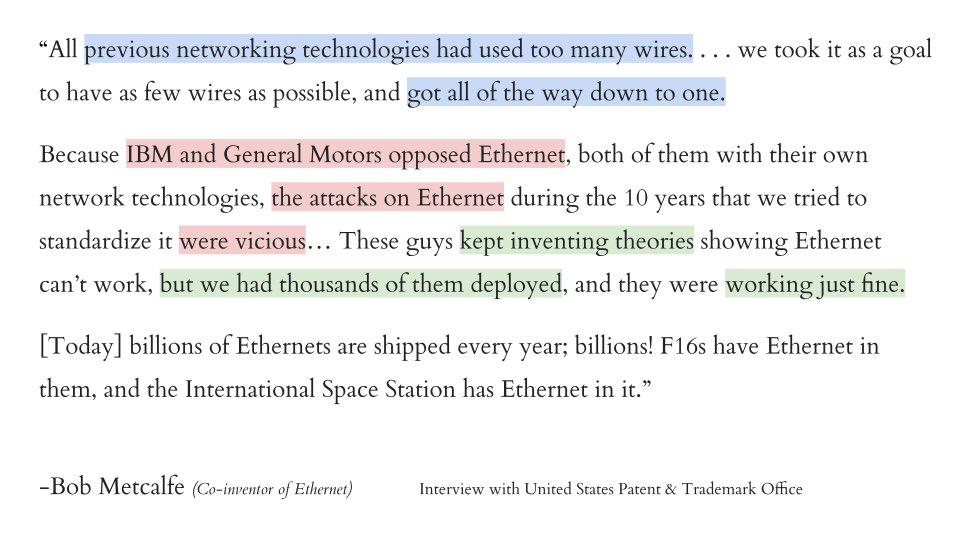

Lessons from Ethernet

Monolithic incumbents that have meticulously built out proprietary closed networks and locked in customers over the course of decades are not going to hand over the keys to the kingdom. Challenging them is a David vs. Goliath undertaking, requiring a similarly shrewd strategy.

The script flips when the environment changes and size is no longer sufficient to sustain advantage. Instead, firms (and their respective technologies) that are nimble and adaptive to change hold the best prospects.

Bob Metcalfe describes the hurdles placed in Ethernet's path.

Money is a Network

Like the benefits derived from speaking the same language (coordination, efficiency, accuracy, etc.), the benefits derived from using a common money to communicate value are equally attractive.

"Think of each individual as a potential trading partner. As individuals adopt the common medium as a standard of value, all existing participants in the monetary network gain new trading partners, as do the individuals that become part of the network." —Parker Lewis

The largest and most valuable network in the world is that of money.

And just like the singular global market created by the internet for information, goods, and services, money is the next prize for the taking.

And there will be only one.

"Money is a network. Some networks are singular, i.e. winner-takes-all. Money is such a network." —Gigi

It is no wonder that sovereign governments have held this privilege so tight in their grip. The power to decree what money is, and hold the monopoly rights on issuance, is the power to rule over all resources and citizens.

But Goliath's weakness was his size (attack surface) and strategy (failure to innovate).

Now the Industrial Age is drawing to a close and with it the strategies that enabled dominance over others.

Anti-fragility, transparency, neutrality, auditability: these are the new properties upon which digital money (and the networks upon which it exists) will be assessed. Because if humans have learned anything from rise of digital networks, it's that they're market-driven, bottom-up, opt-in phenomena.

So place your bets.

Extra Credit:

In the Digital Age there will not be 100’s or 1000’s of different monies.

— Anil ⚡ (@anilsaidso) October 25, 2021

There will be only one.

Today, all logic points to it being #Bitcoin

THREAD. pic.twitter.com/QMbf5nCRNM