Betting on Bitcoin Co's

Below is my experience angel investing in bitcoin startups.

[This blog is an expanded version of a 2022 twitter thread]

Opportunity Cost

The first thing everyone naturally asks: why angel invest when the opportunity cost is owning bitcoin?

It's a great question that comes with uniquely personal answers. The time-horizon of angel investing (~8 yrs on avg. before any potential liquidity event) forces me to look at teams and products (and possible pivots) with a multi-decade view. I also have a desire to see certain tools/products/service brought to market that I believe will accelerate bitcoin adoption.

The other part is determining if a company has the potential to generate positive sats flow. This is a term coined by Grant Gilliam of Ten31 the I've come to love. He lays out the general point here:

Bitcoin companies are backed by bitcoiners, and the common goal among every bitcoiner is to obtain more bitcoin. Under a Bitcoin standard, earning bitcoin today will generally require less work than earning the equivalent amount of bitcoin in the future. Said another way, for the same amount of work you will earn less bitcoin in the future.

Access

I am not an ex-employee of a name-brand VC, I didn't attend a prestigious university, I don't live in the Bay Area, and I don't come from money.

Being invited into a deal usually comes from your reputation.

The only tool I use to build my reputation and form relationships is Twitter. And the way I do that is by creating quality educational bitcoin content. No special tricks, just sustained effort over several years.

The first deal I ever did was sending a cold email to the founder of a product I used and loved. It was quickly gaining popularity and so I expected to hear radio silence. Instead he replied, solely because someone recently sent him a thread of mine. There was no reason for him to take a cheque from me vs. other better-known and better-capitalized angels who has already expressed interest in the round.

Timing also mattered significantly. The difference of a couple of weeks, and I'd have definitely been shut out. This experience taught me just how much randomness and luck plays in a deal (and not to attribute every perceived win as some unique skill or insight).

I'm aware that there are specific rules around who can invest in what, often creating a barrier. All I am going to say on the topic is to deeply research both of these things. Rules are constantly changing across jurisidictions.

You won’t always have direct access to a founder, or it may be cumbersome for them to accept individual cheques below a certain threshold. This is where syndicates may be preferable if you trust the operator. Some notable bitcoin-only syndicates to look into: @ltngventures, @BitcoinerVC, @Ten31vc.

Selection Criteria

I’ll consume countless hours of interviews, blog posts, and product reviews when assessing a founder. Ultimately, I'm trying to answer the following question: would I want to work with this person (deal terms aside)?

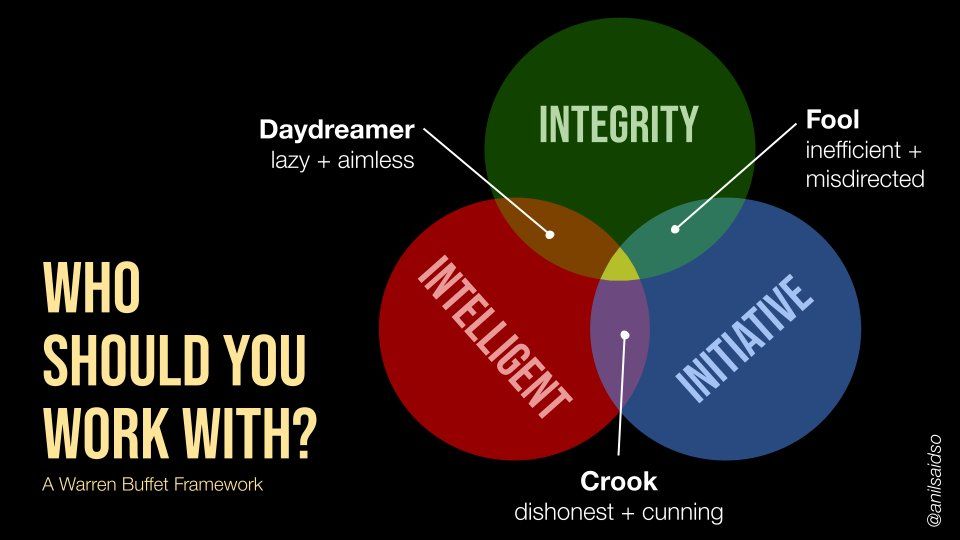

We look for three things when we hire people. We look for intelligence, we look for initiative or energy, and we look for integrity. And if they don't have the latter, the first two will kill you, because if you're going to get someone without integrity, you want them lazy and dumb. —Warren Buffet

Looking Forward

Bitcoin is still very early in its monetization journey, but the venture landscape is starting to mature (slide from Trammel Venture Partners' 2022 Research Brief).

As larger firms (with deeper pockets + sharper minds) start to wade in, I must recognize that I don't have any specific edge in this field when competing with someone dedicating their entire bandwidth to the craft. As such, I am unlikely to make any further angel investments for the time being (I'm saying this because I still regularly receive pitches from bitcoin startups).

Overall, this has taught me far more about capital formation and private markets than sitting passively in a business-school classroom. The saying continues to prove accurate: learn by doing.

The Bitcoin Handbook

A collection of the most helpful frameworks, mental models, and heuristics for making sense of money in the Digital Age.