Generation ₿: Two Billion Strong

Bitcoin's success as money is dependent on it being more useful than available alternatives. This could be in relation to any number of desirable monetary properties (scarcity, censorship-resistance, fungibility, etc.), but there's one that I believe is often under-appreciated: established history.

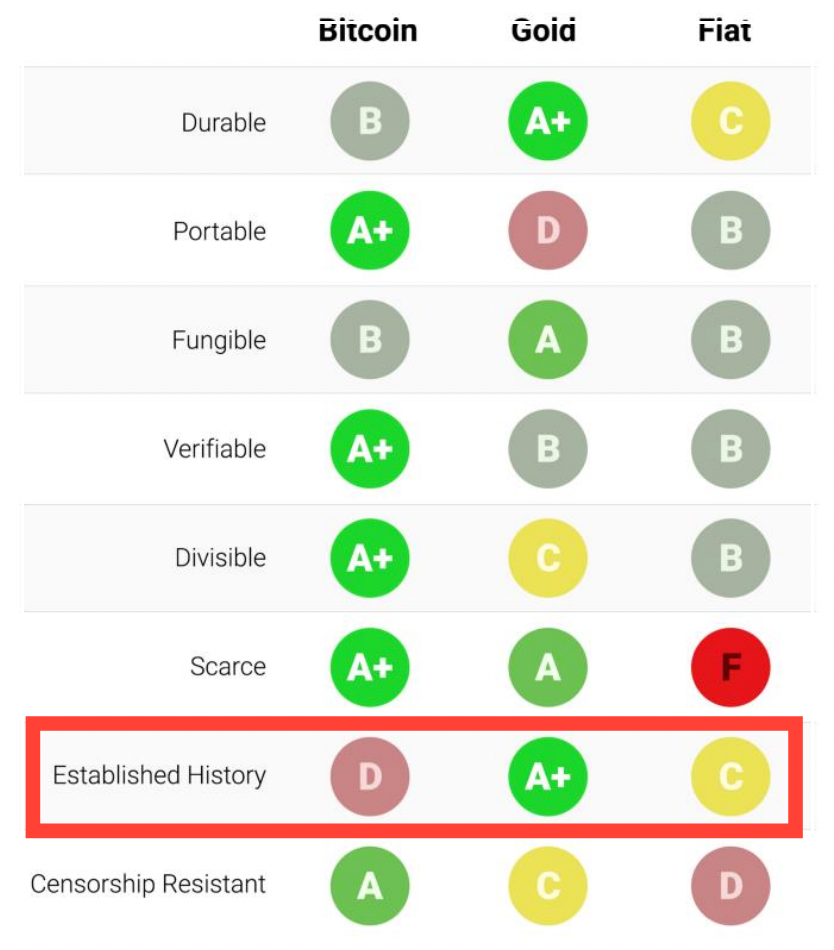

Many of you will remember this table from Vijay Boyapati's 2018 article (and now book) The Bullish Case for Bitcoin:

Notice that bitcoin doesn't score well along this dimension relative to gold. Its brief 14-year existence is nothing in comparison to over 5,000 years!

But let me ask you about Uber or WhatsApp or Slack or Venmo. Chances are at least one of these companies (or competitors) has become an essential feature of your life. Now what does this have to do with bitcoin? Well, they were all established in 2009. In 14 years they've become mainstays, with many finding it hard to remember what it was like before their existence.

The point is: time is relative.

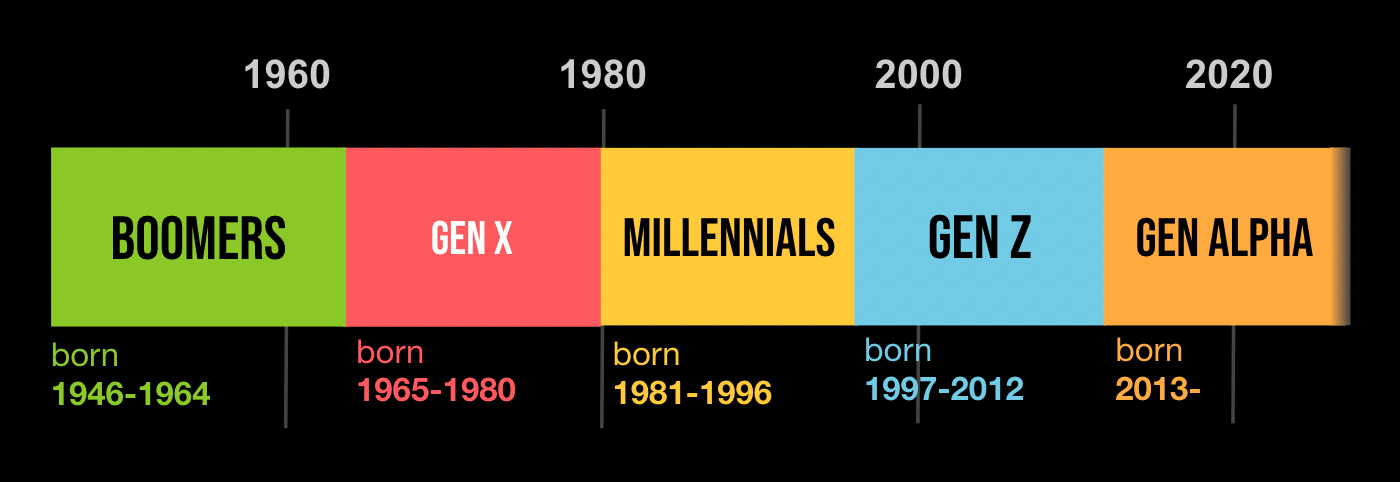

Many bitcoiners like to refer to the genesis block as the cornerstone of a new calendar- pre-bitcoin and post-bitcoin. When thinking about generational boundaries, we can see that most Gen Z'ers and all Gen Alpha's will not remember a world without bitcoin.

"People’s perception of something that is permanent is- has it existed during my lifetime? Kids who were born when bitcoin was created are 14 years old now..Their perception of bitcoin’s permanence will be very close to gold’s." —Vijay Boyapati

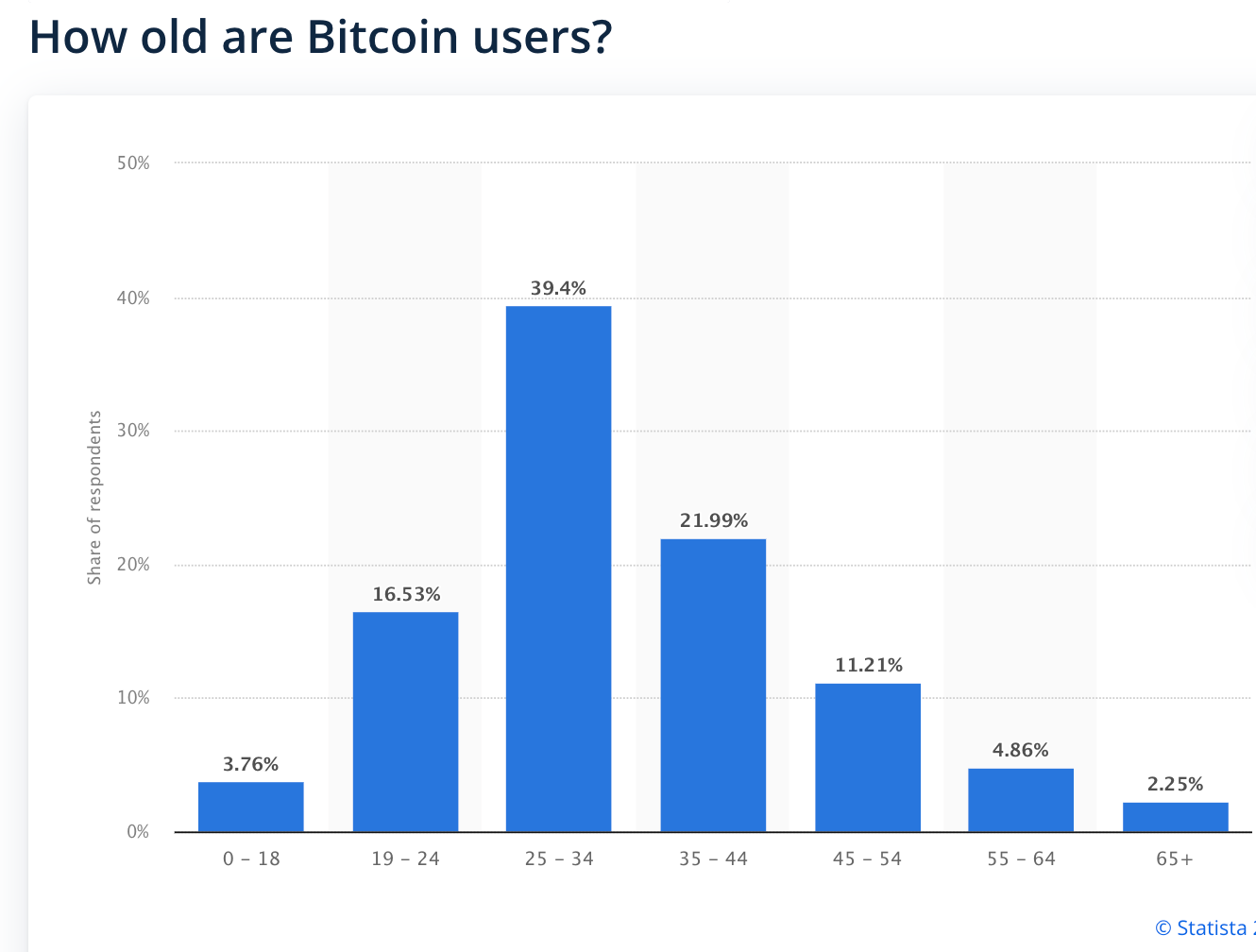

There have been many surveys attempting to pinpoint the demographics of bitcoiners. While we can never know for sure, it's a safe assumption that it skews to middle-aged for obvious reasons (technologically proficient, some disposable income, less conservative investments, general distrust of institutions, etc.). This chart from Statista paints a reasonable picture:

But we have to think about what might it look like in the future and which age group/s will drive adoption? There's no point in holding an asset for a multi-decade period if you don't believe it will be embraced by the next generation (cough, cough..gold).

How Big is Gen ₿?

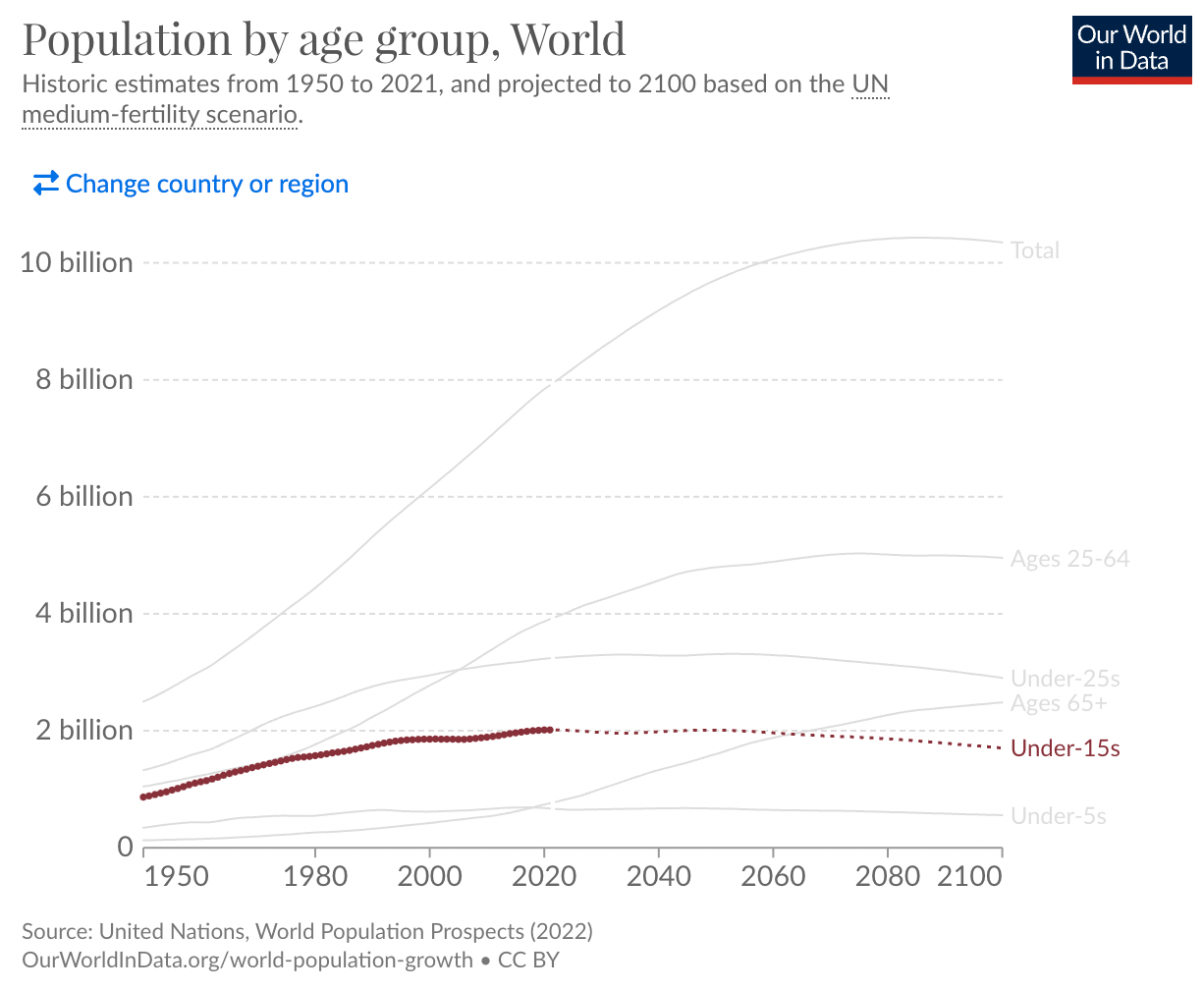

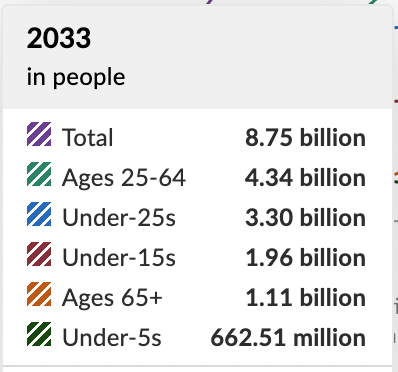

Today, 2 billion people (U15) do not know a world without bitcoin in it.

Ten years from now (2033), that number (U25) balloons to a whopping 3.3 billion.

So the question becomes: Will bitcoin get a better grade in the category of established history in 10 years time? If so, bitcoin's report card suddenly becomes that of the perfect student (money). And you may want to bet on it. Because everyone must place a bet and choose what to save their purchasing power in.

On Established History

Just because something has been around for a long time does not make it immune to obsoletion by way of technological innovation. This is especially true for monetary goods. Think of all the commodities and metals that were once used as money before innovation made them abundant (removed their ability to predictably preserve value over time) or some other discovered good improved upon one or more monetary properties.

Goldbugs: Gold has been around for 5,000 years!

— Anil ⚡ (@anilsaidso) March 26, 2023

Saltbugs: Salt has been around for 8,000 years!

Copperbugs: Copper has been around for 11,000 years!

Longevity doesn't protect you from demonetization through innovation.

Innovation demonetizes.

So bet with the future in mind as opposed to past.

News & Announcements

Italian release of The Bitcoin Handbook

This joins Turkish and Korean. Don't worry many more languages will be released very soon.

Recent appearance on Simply Bitcoin

Investment in Bringin

While I've paused all angel investing activity for the moment, I recently made an exception to invest alongside Stephan Livera in Bringin.

I'm also joining this round as an investor in @bringinxyz.

— Anil ⚡ (@anilsaidso) September 22, 2023

Have been impressed by @prashanthc123's thoughtfulness and focus in reducing friction in bitcoin↔️fiat transactions within the EU. https://t.co/YScK0vDWek pic.twitter.com/9WflNWQZkU